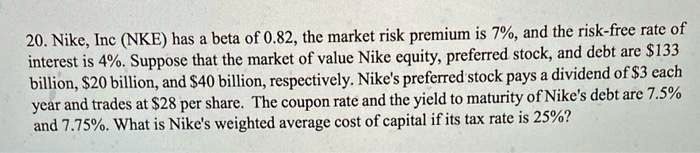

SOLUTION: Toaz info nike inc cost of capital case analysis pr c7721ab703929f398c3e6f5059e6aa10 - Studypool

![SOLVED: Question25 uppose the Nike and Starbucks stocks (and the risk-free rate) have the following statistics (rnikel 18%Oe 28% 025 [starbucks] 12%Osuarbucks 21% Risk-free 0 0.2 0.15 Starbacks K 0.1 0.05 Risk-free SOLVED: Question25 uppose the Nike and Starbucks stocks (and the risk-free rate) have the following statistics (rnikel 18%Oe 28% 025 [starbucks] 12%Osuarbucks 21% Risk-free 0 0.2 0.15 Starbacks K 0.1 0.05 Risk-free](https://cdn.numerade.com/ask_images/b43d44501b7e43c3b4c503edd678b078.jpg)

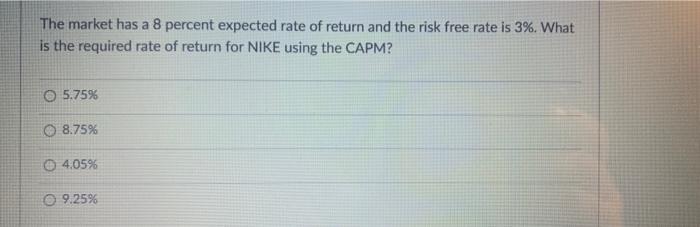

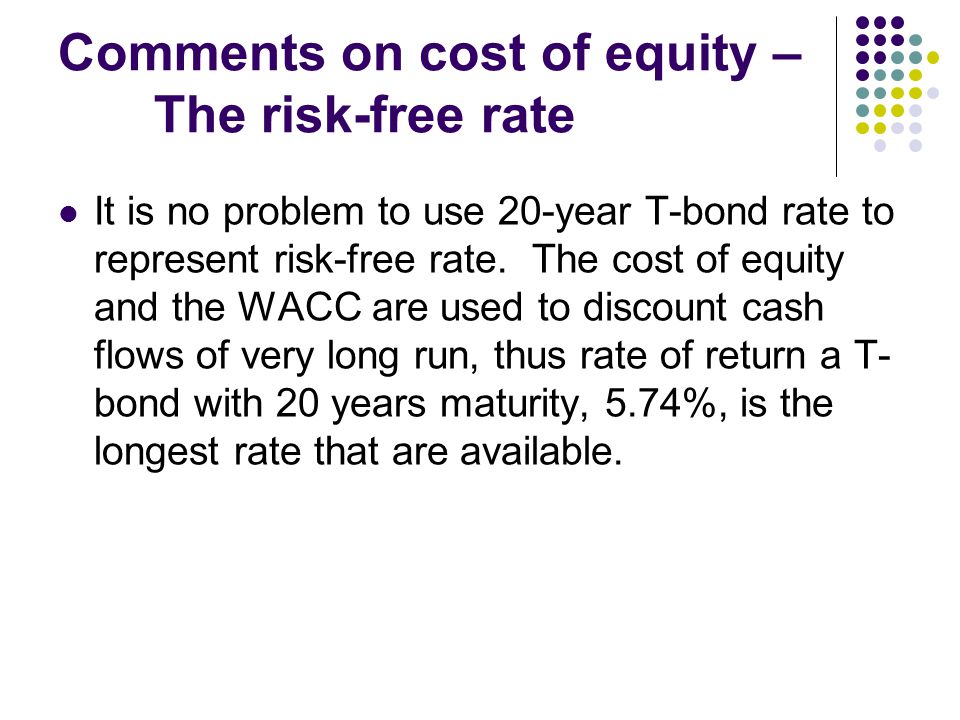

SOLVED: Question25 uppose the Nike and Starbucks stocks (and the risk-free rate) have the following statistics (rnikel 18%Oe 28% 025 [starbucks] 12%Osuarbucks 21% Risk-free 0 0.2 0.15 Starbacks K 0.1 0.05 Risk-free

![SOLVED: 0 6 32 0 6 00 0 Trisk-free 6E[rsuarbuc] 5E[r] Question 23 0.72 0.64 0.56 0.48 4% Prbs 12%Grbocks 18%O 21% 28% Suppose the Nike and Starbucks stocks (and the risk-free SOLVED: 0 6 32 0 6 00 0 Trisk-free 6E[rsuarbuc] 5E[r] Question 23 0.72 0.64 0.56 0.48 4% Prbs 12%Grbocks 18%O 21% 28% Suppose the Nike and Starbucks stocks (and the risk-free](https://cdn.numerade.com/ask_images/0f4eefa270ae4dbc8e13410c29e79404.jpg)

SOLVED: 0 6 32 0 6 00 0 Trisk-free 6E[rsuarbuc] 5E[r] Question 23 0.72 0.64 0.56 0.48 4% Prbs 12%Grbocks 18%O 21% 28% Suppose the Nike and Starbucks stocks (and the risk-free

:max_bytes(150000):strip_icc()/risk-freerate.asp-edit-a2c93f907857401dad61e4bde612c04a.jpg)

:max_bytes(150000):strip_icc()/VW-Fit-v2-7-best-nike-walking-shoes-4178922-primary-ccbc79d9b4c84904b15eacd45865541d.jpg)