Amazon.com: The 2010 VAT Directive and the Case Law of the Court of Justice of the European Union: 9789050958974: Bernaerts, Yves, Robinson, Philip: Books

Fraud 2006/ 112/EC VAT fraud – Luxembourg delegation 2012 Fight against fraud VAT Fraud. - ppt download

Request for a preliminary ruling — Supreme Administrative Court-Bulgaria — Interpretation of Articles 63, 65, 73 and 80 of C

VAT-Exemptions Legal bases Diplomatic missionsInternational organisationsMilitary forces Article 151 Directive 2006/112/EC ( Article 15.10 Directive 77/388/EEC) - ppt download

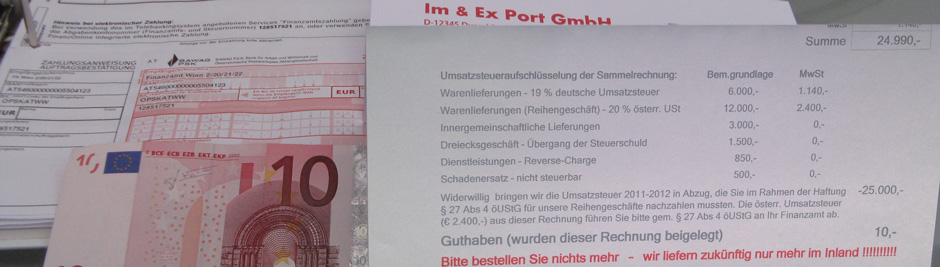

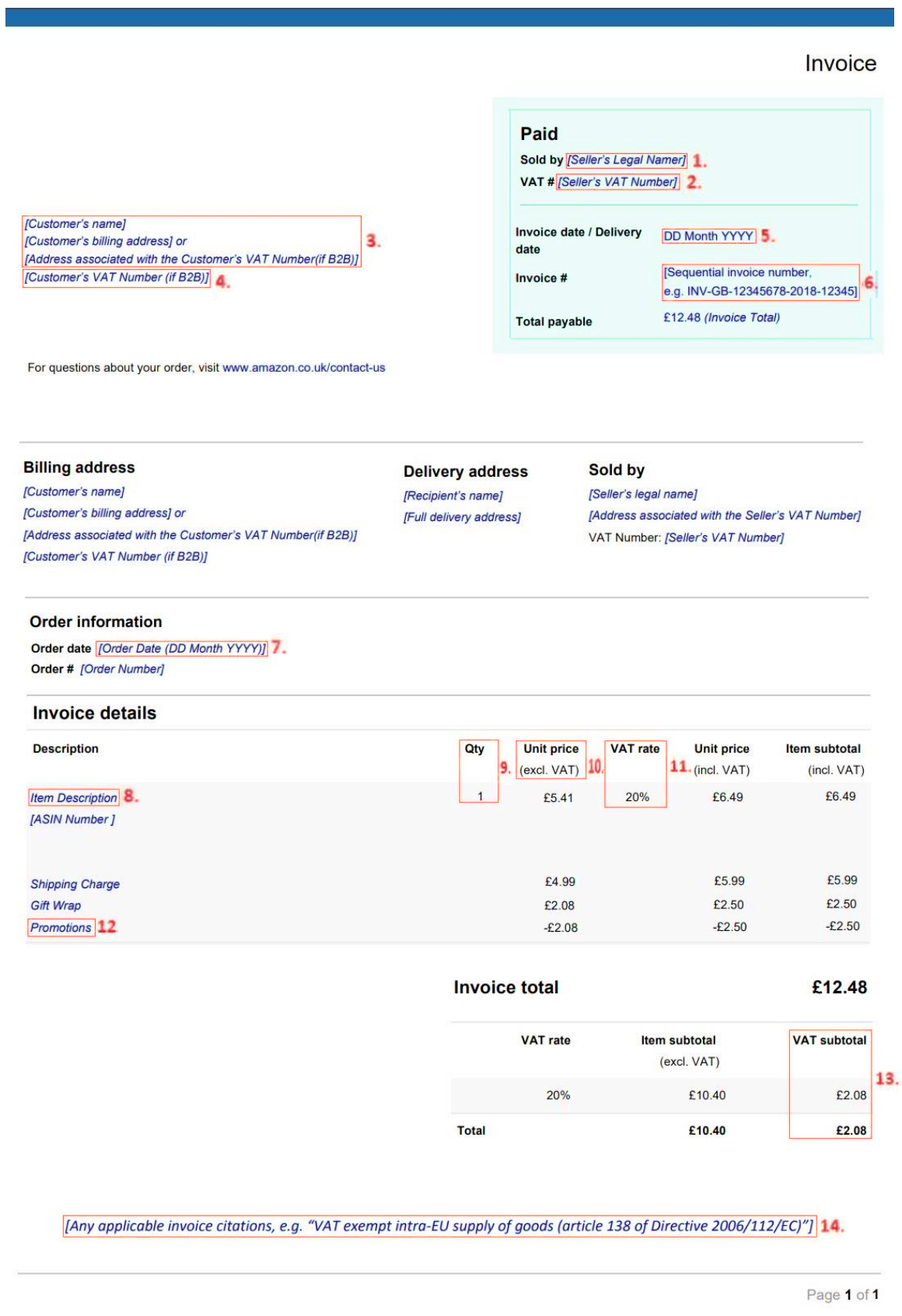

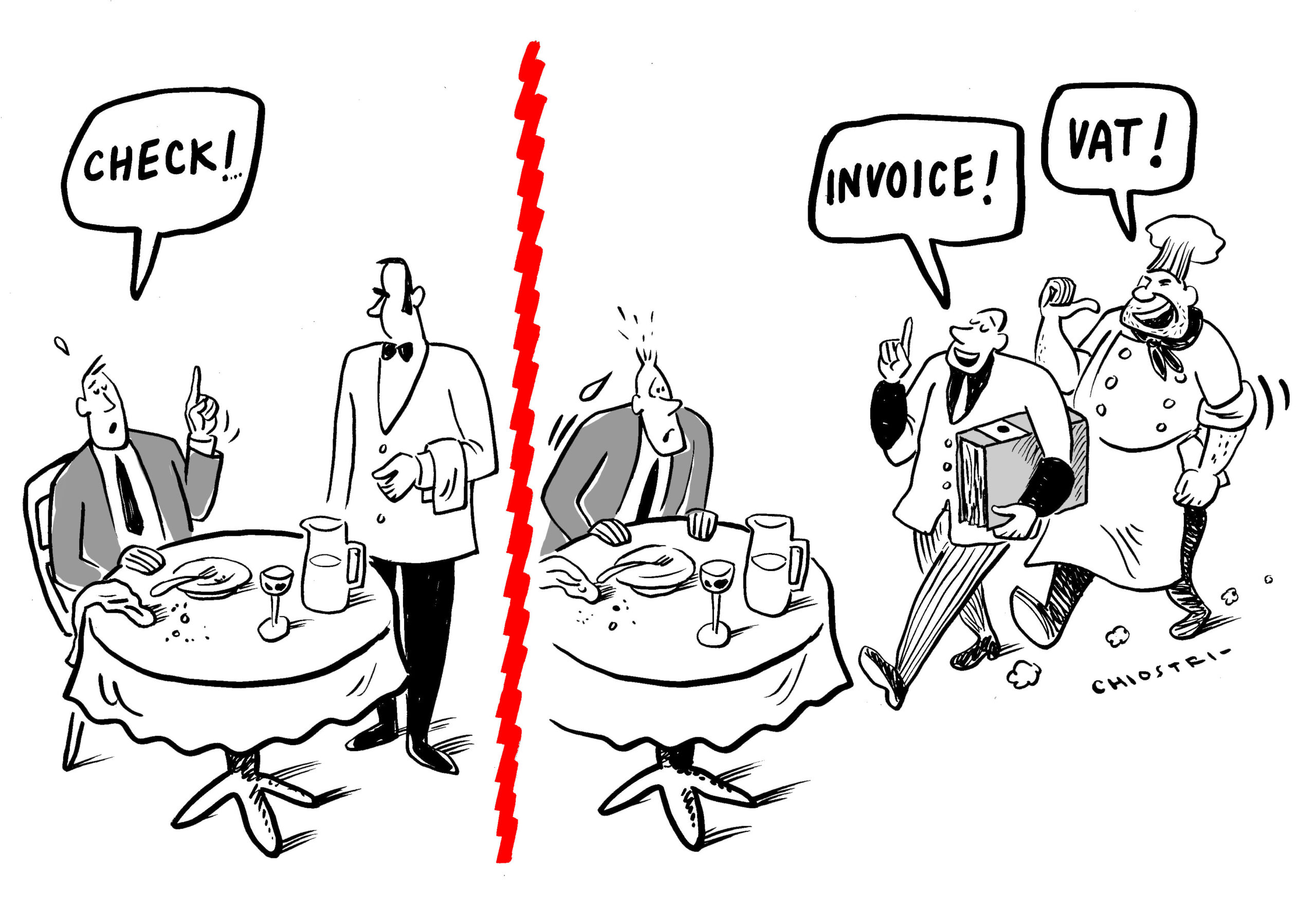

Study on the evaluation of invoicing rules of Directive 2006/112/EC - CASE - Center for Social and Economic Research

COUNCIL IMPLEMENTING REGULATION (EU) 2018/ 1912 - of 4 December 2018 - amending Implementing Regulation (EU) No 2